Customer relationships and channels#

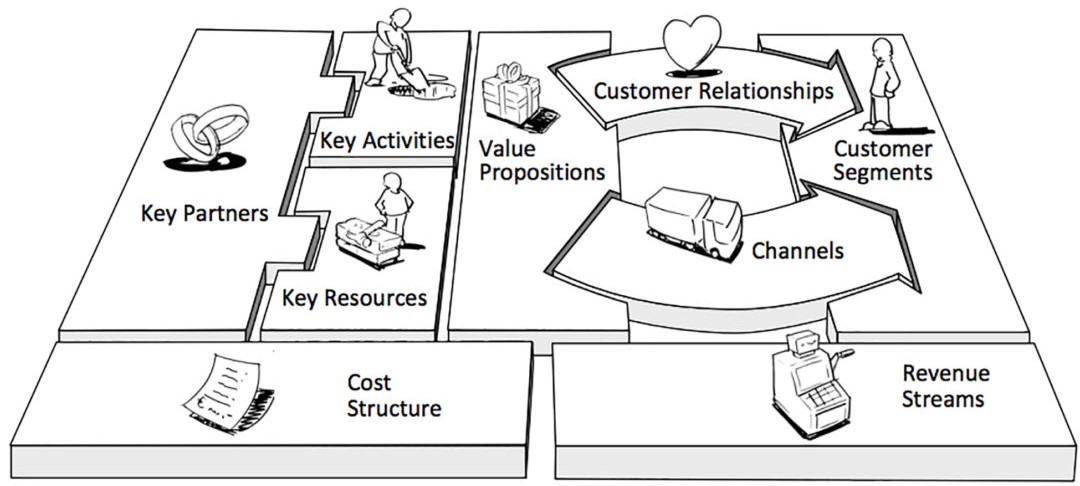

Customer relationship and channels are the links between our value propositions and our customer segments. Recall these from the model in Fig. 23, described in the chapter on the business model canvas:

Fig. 23 Overview of the business model canvas. Source: https://www.strategyzer.com/#

Channels the mechanisms by which solutions are delivered to customers.

Customer relationships are the mechanisms that are used to engage and build trust between organisations and customer segments.

Customer relationships: Get, keep, and grow#

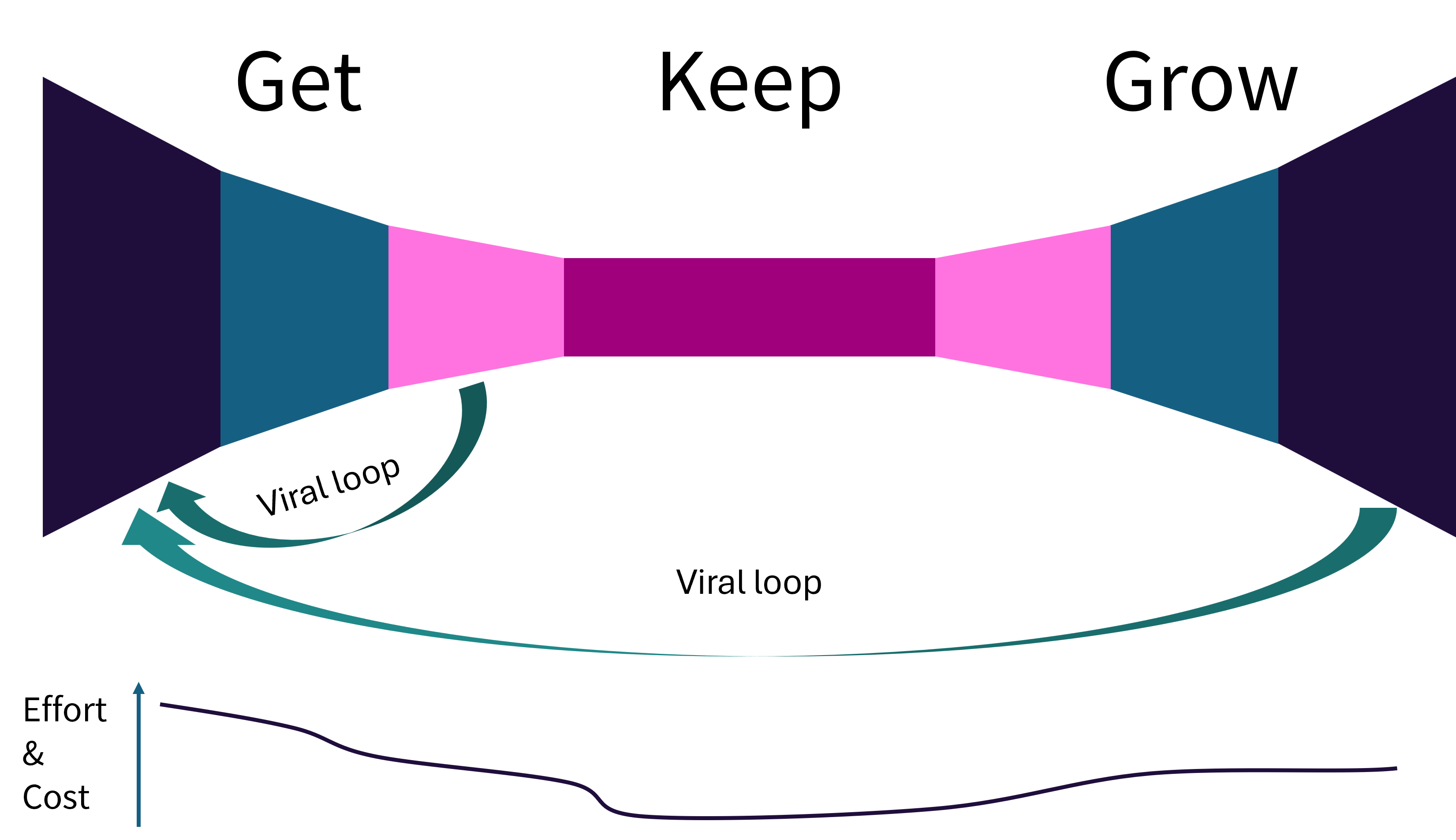

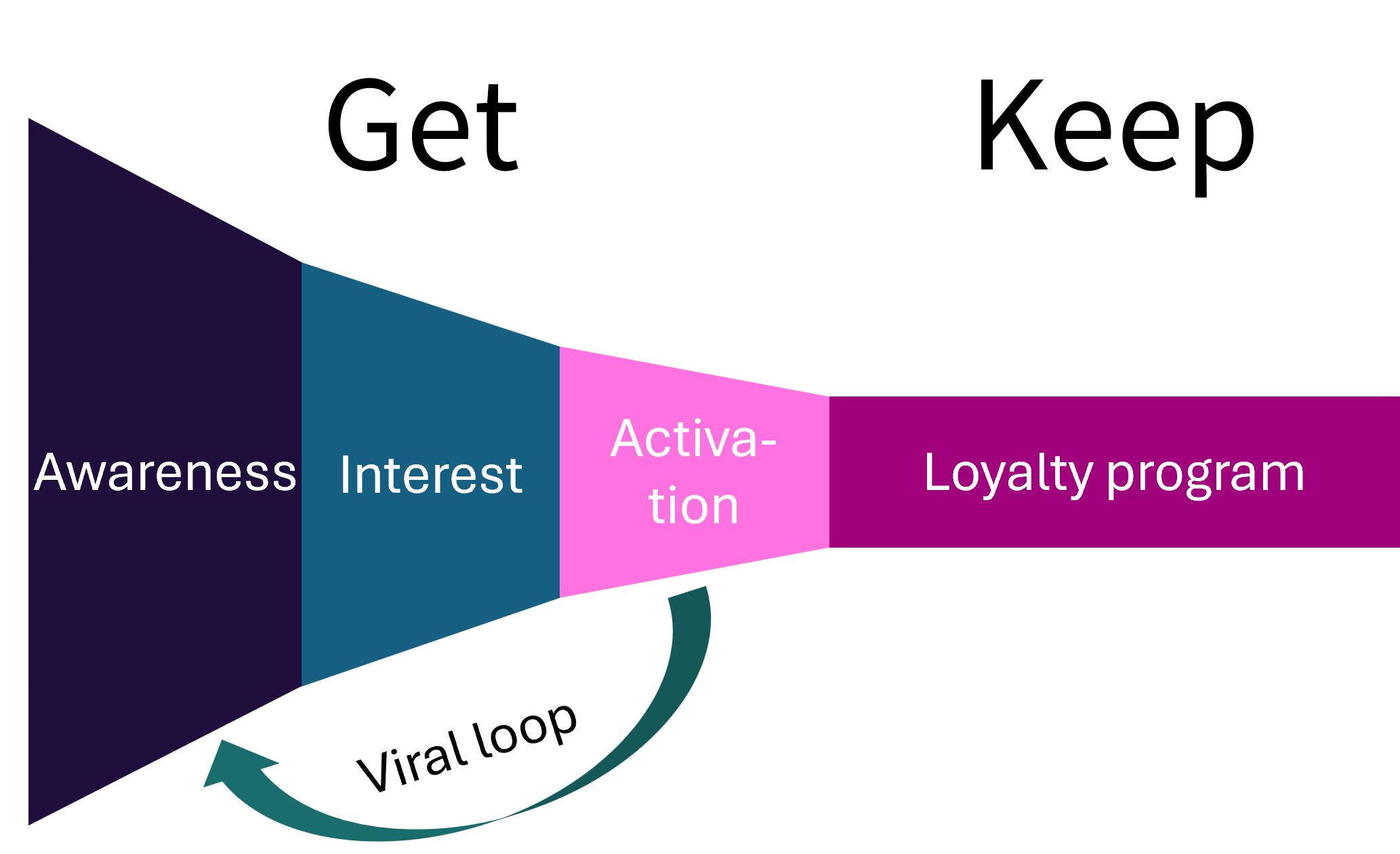

Fig. 24 outlines the three main stages to gain customers via customer relationships:

Get: bring initial customers into our product; e.g. early adopters.

Keep: keep the customers that we have.

Grow: grow into new customers; e.g. the early and then late majorities.

Fig. 24 An overview of the ‘get, keep, grow’ model.#

As we can see from Fig. 24, typically, getting the initial customers takes a lot of cost and effort. Keeping them is less effort and cost, provided we have a good product. Growing is more costly than keeping, but if we have a good product and this spreads via word of mouth from existing to new customers, this growth can be sharp. In fact, this can often cause problems for startups as they cannot keep up with the new demand. While this is less of a problem for software applications than say, physical products, it can still be difficult to e.g. find the necessary computational resources, or find the staff to provide customisations for particular customers.

The two viral loops indicate situations in which we get lucky and the ‘getting’ and ‘growing’ happen with minimum effort from us: our customers using the product raises awareness with new customers. For example, customers telling other people about the product; or if our customers are businesses using our product to serve their own customers, their customers may see our product, raising awareness.

Foundations for customer relationships#

Customer relationships are important for getting, keeping, and growing our customer base. This includes both users and paying customers.

If we want strong customer relationships, we need to be able to answer the following questions:

Who are our customers?

What is their motivation for using our product? What matters to them?

Where do they get their information about products?

What (or who) influences them?

How do they buy things?

Hopefully, our customer discovery process has given us a clear idea of the first two questions.

The latter questions can be framed as hypotheses and tested, in the same way that we frame and test hypotheses about customer segments and value propositions.

However, we can see that different types of customers have different needs. An older person using a medical alarm is less likely to use social media to research products than younger users of educational apps. Similarly, they are influenced by different people, and buy things differently. For example, younger demographics are much more likely to buy on their mobile device, while generation X would be more likely to use a laptop/desktop computer for large purchases. Older people may prefer to purchase things in physical stores — although this preference is starting to reduce as everyone becomes more digitally literate.

Example: A web and mobile product#

Getting customers#

Consider the example of a product we are releasing on the web to be used on desktop and mobile devices. What does the ‘get’ phase look like?

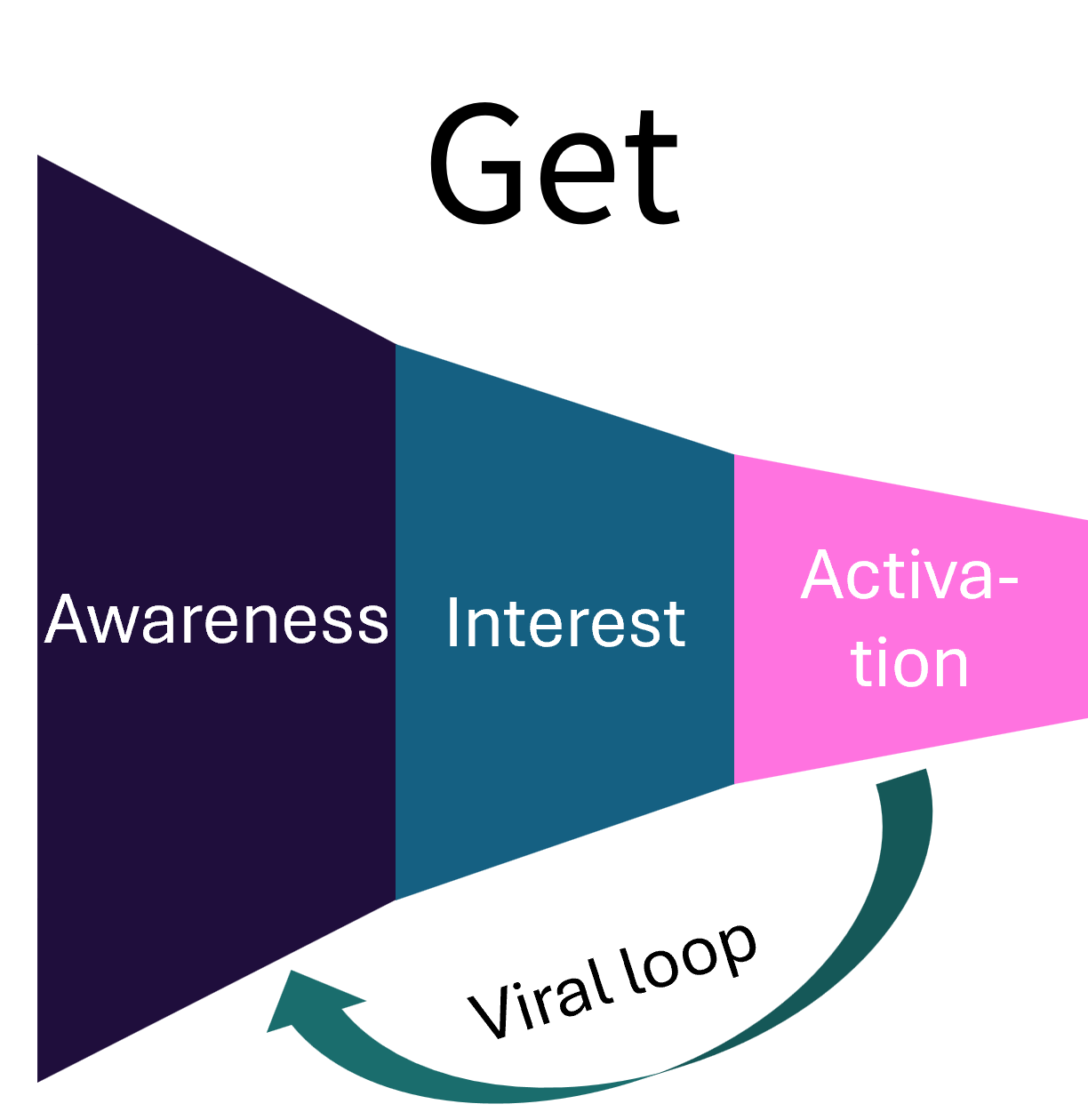

Fig. 25 An example strategy for the ‘get’ stage of a web and mobile application.#

Fig. 25 shows the strategies we could take:

Awareness: this represents the initial stage where customers become aware of a product or service.

Interest: the middle stage where those who are aware of the product or service show interest in it.

Activation: the third stage where interested individuals take action, such as signing up, purchasing, or engaging further.

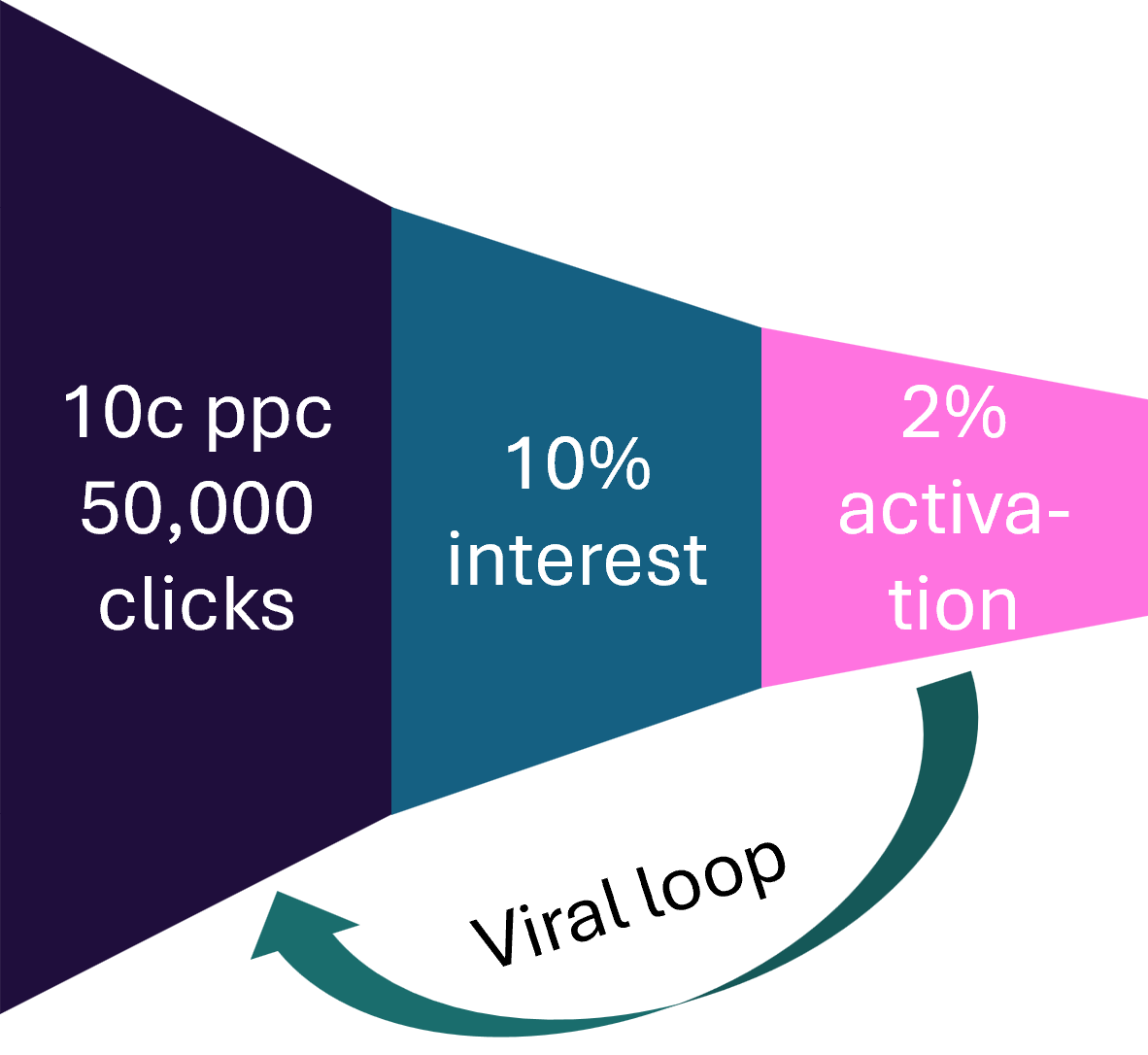

Fig. 26 An example of the ‘get’ stage of a web and mobile application.#

How do we implement these strategies? Fig. 26 outlines some approaches we could use:

Pay for Internet advertising at 10c per click, at a maximum of 50,000 clicks.

10% of people who see the advert show some interest.

2% of people who see it activate by signing up to our product.

There are other ways to raise awareness. Some strategies are paid demand creation:

Use a public relations agency.

Attend trade shows.

Use email campaigns.

Social media engagement.

We can also use earned demand creation:

Publication in peer-reviewed journals.

Conference appearances.

Blogging and guest articles for media.

Search Engine Optimisation.

Social media presence.

Keeping customers#

As noted, if we have a good value proposition, keeping customers is lower cost and effort than getting them initially. In short: the customers we have are easier to keep than getting customers we don’t have. The reason is that these customers have already acted on their problem, so they have signalled clearly that they are in our customer segment.

Fig. 27 An example strategy for the ‘keep’ stage of a web and mobile application.#

There are several strategies that we can use to keep customers:

Loyalty programs.

Product updates to keep their interest and continue adding value.

Contests and events to keep engagement.

Horizontal and vertical offerings.

Customer engagement and satisfaction programs; e.g. blogs, community support, email.

Social media.

However, this leads to a question: Why should we focus on ‘keeping’ existing customers that we already have, instead of gaining new ones that bring new income?

The answer is: it is more expensive to get new customers than keep existing ones.

This is known as churn, and it comes at a cost.

For example, consider monthly churn of 1%, 5%, and 10%. After 3 years, how many of the original customers will be left?

We can calculate the remaining customers as \(Remaining\ percentage=(1−Monthly\ attrition\ rate)^n\), where \(n\) is the number of months.

Monthly customer churn |

Remaining customers after 3 years |

|---|---|

1% |

\((1−0.01)^{36} = 69.8\%\) |

5% |

\((1−0.05)^{36} = 16.6\%\) |

10% |

\((1−0.10)^{36} = 3.14\%\) |

This is a massive difference: reducing attrition from 5% to 1% will result in over four times as many of our original customers, and from 10% to 1%, over 22 times as many.

Similarly, we can see calculate the average duration that a customer stays with different churn rates:

Monthly customer churn |

Average Duration (Months) |

|---|---|

1% |

\(\frac{1}{0.01} = 100\) months |

5% |

\(\frac{1}{0.05} = 20\) months |

10% |

\(\frac{1}{0.10} = 10\) months |

Growing customers#

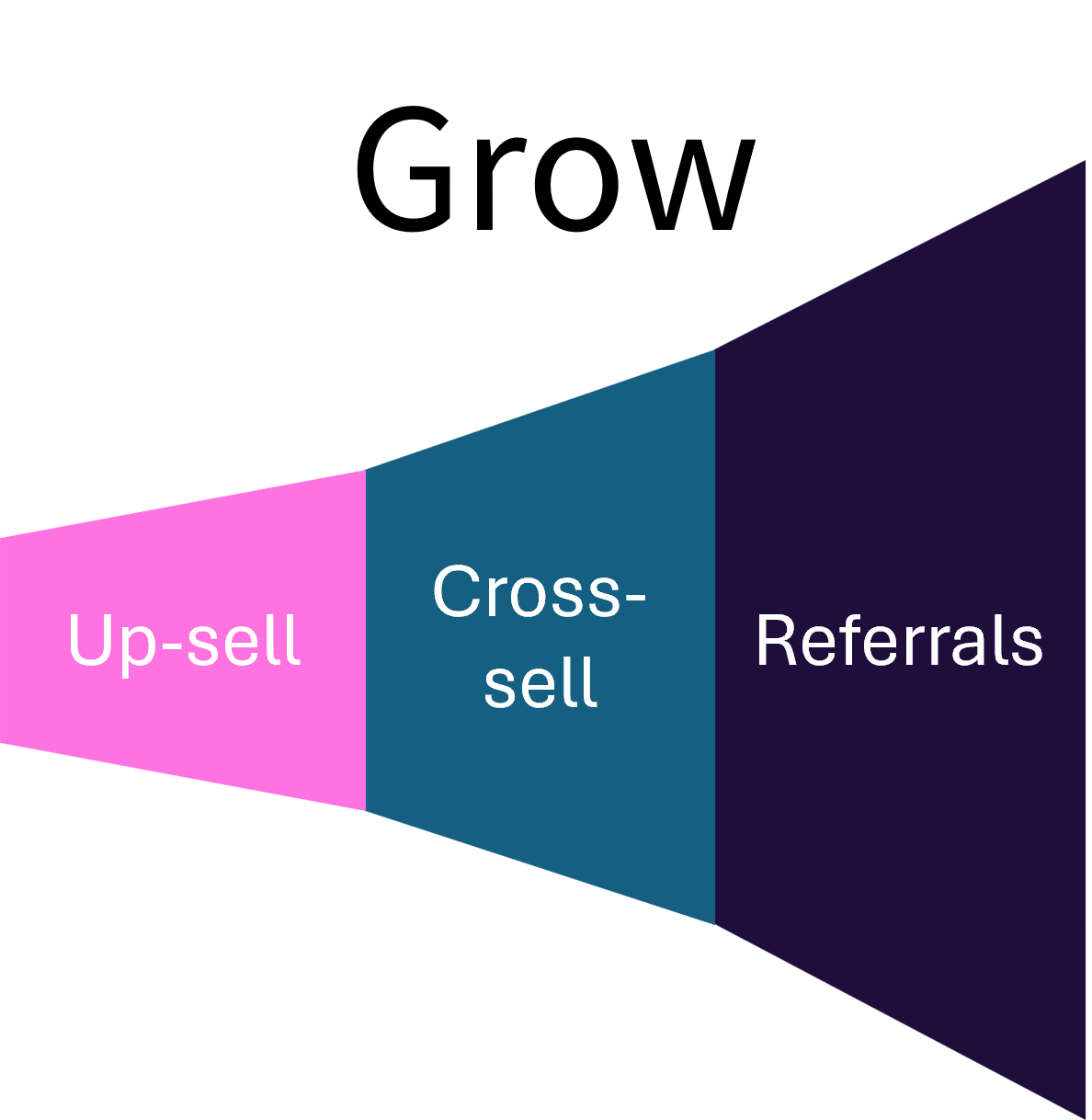

Fig. 28 An example strategy for the ‘grow’ stage of a web and mobile application.#

To grow customers with our web and mobile product, we can use several different tactics, such as:

Un-bundling: split products into several smaller products.

Freemium: give away a basic product at no cost, but a premium product that customers pay for.

Up-sell and next-sell (vertical): one base product with multiple brands and features.

Cross-sell (horizontal): companion products to go with a product.

Referral programs: give incentives for customers to introduce new customers.

Recall from Fig. 24 that good strategies for growing can result in viral loops and grow further – which can be great (more income) and painful (the demand can grow quicker than our ability to service it).

Channels#

With regards to distribution channels, there are two main types: direct distribution and indirect distribution.

Direct Distribution Channels

Dedicated e-Commerce: This involves selling products or services directly to customers through a company’s own online platform, such as a dedicated website or mobile application. This channel allows for direct customer interaction and control over the sales process.

Social Commerce: This refers to the use of social media platforms to promote and sell products directly to consumers. Social commerce leverages the reach and engagement of platforms like Instagram, Facebook, or TikTok to drive sales directly within the app or by linking to external e-commerce sites.

Indirect Distribution Channels

Marketplace (e.g., App Store): Selling products or services through third-party platforms like an app store (e.g., Apple’s App Store, Google Play, Microsoft Software Centre). These provide access to a large customer base but usually involve sharing revenue or paying fees to the platform provider.

Two-Step Distribution: This involves selling products through intermediaries, such as wholesalers or retailers, who then sell the products to the end customers. Common in industries where large-scale distribution networks are necessary to reach a broad audience.

Aggregators: These are platforms that gather offerings from multiple providers into a single platform (for a price), making it easier for customers to compare and purchase products. Examples include travel booking sites or food delivery apps.

Product-channel fit#

Much like we have a product-market fit in our business model, we should also have a product-channel fit — that is, the product (value proposition) and the distribution channels must fit together, as illustrated in Fig. 29.

Fig. 29 Product-market fit.#

While software was once sold on DVDs, people will not buy mobile apps on DVDs! In fact, they are highly unlikely to download one and install if there is an alternative via an app store. It is sometimes easy to see a product-market fit for software-related solutions; e.g. the easiest way to sell mobile applications is to place them on app stores. However, desktop applications may require a set of different channels, such as direct purchase from a company website, upload to a software centre, via package managers, etc.

Physical Channel |

Virtual (e.g. Web/Mobile) Channel |

|

|---|---|---|

Physical Product |

Cars, Clothes, Books, Groceries |

Clothes, Books, Groceries |

Virtual Product |

PC Games, DVDs |

Digital music, Online Games, Podcasts, eBooks |

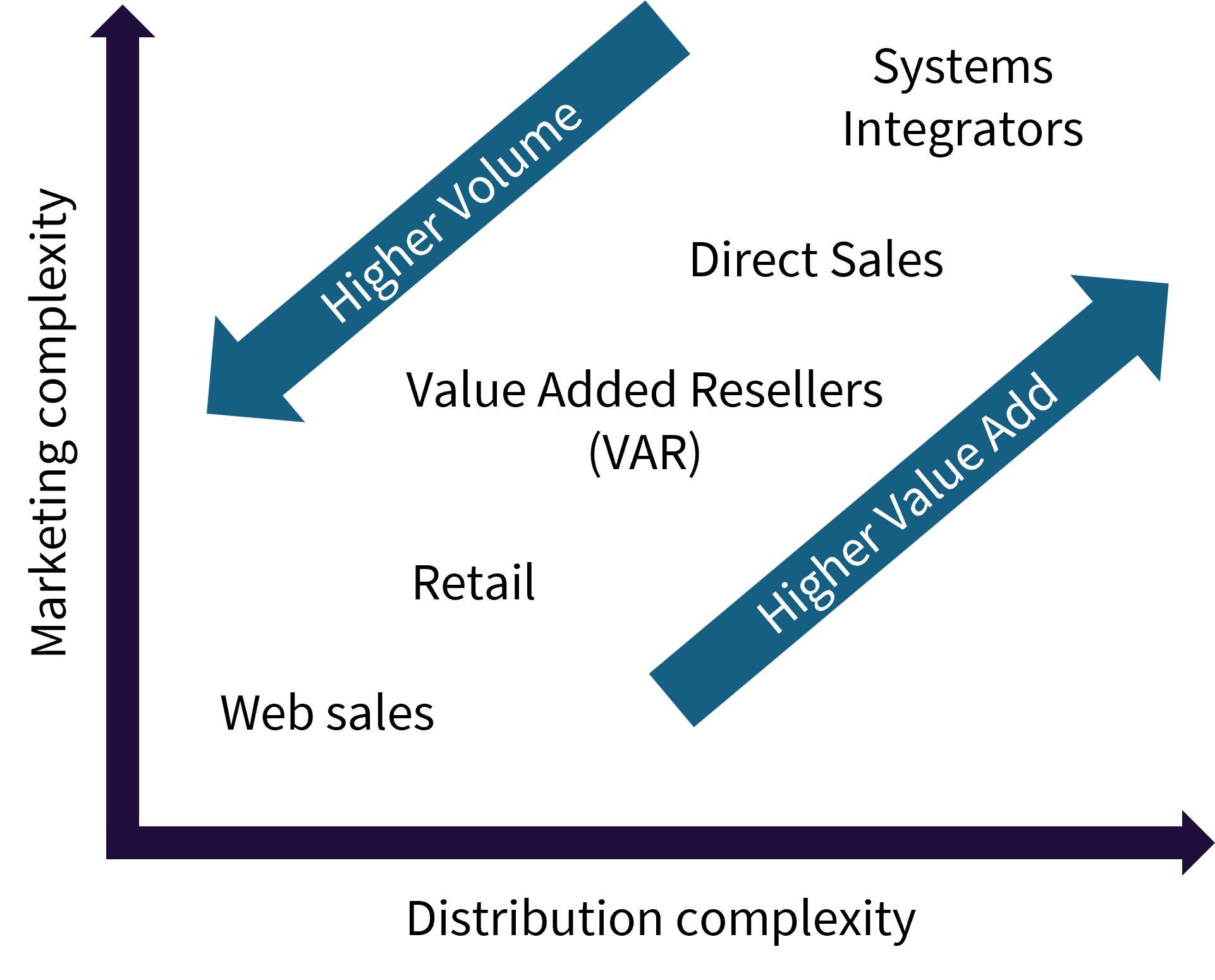

Channel complexity#

One final lesson that we can learn from the experience of others, is that there is a relationship between solution complexity and marketing complexity.

Fig. 30 illustrates that as distrubution complexity increases, often marketing complexity does too. Further, this correlates with a higher value add, and negatively correlates with the ability to scale volume.

Fig. 30 Relationship between distribution complexity, solution value, and marketing complexity.#

For example:

Web sales: Simple products that can be easily sold online can usually be advertised online with simple marketing via online ads and social media.

Retail: This requires a bit more effort to market due to the need for physical presence and in-store promotions.

Value Added Resellers (VAR): A value-added reseller takes another organisation’s product and adds new features/services before reselling; e.g. they sell someone’s product and offer support, installation, etc. This often requires more detailed marketing to explain the added value.

Direct Sales: This involves personalised selling, requiring tailored marketing approaches.

Systems Integrators: Organisations who integrator other sytems often handle the most complex solutions, needing specialised marketing strategies to communicate the benefits of the integration. Often the integration can be personalised to specific organisations/people, meaning much higher complexity in marketing.

Of course, this is not a law of physics: it can be that some simple solutions are difficult to market, and vice-versa, but the trend is common.

What does this mean for our startup product? It is a lesson that keeping the solution simple, especially early on, helps us to get marketing up and running more quickly. This leads to earlier sales to our early adopters and early majority customers.

Customer feedback#

Finally, it is important to note that, just like every other part of our customer discovery process, we should actively seek out input from our customers about our distribution channels and relationship strategies. This includes testing out hypotheses early with e.g. interviews, and analysing customer feedback after release.

Takeaways#

Takeaways

Customer relationships are required to help you get cusomters, keep customers, and grow our customer base.

Keeping existing customers is easier and cheaper than getting new customers – we shouldn’t neglect our existing customers in the race to gain new customers.

Customer channels allow us to distribute our products. We should aim for a good product-channel fit.

More complex solutions are often more complex to market and distribute. Another reason to keep it simple for our minimum viable product.